The Troubles Of India’s Aviation Industry

Context:

- On May 8, the airline was ordered by the Directorate General of Civil Aviation (DGCA) to immediately stop selling tickets. For failing to “continue the operation of the service in a safe, efficient, and reliable manner,” the DGCA issued a show-cause notice to GoFirst.

- Despite being hailed as the “fastest-growing aviation sector” in the world, local airlines have had difficulty surviving in the brutally competitive field. While travel limitations during the epidemic severely hurt all carriers’ finances, their financial situation was already precarious.

- The layers of expenses related to inadequate infrastructure and policies have an impact on the viability of airlines, which struggle to maintain their competitiveness.

Points to Ponder:

- With over 140 million passengers anticipated in FY2024 alone and a projected capacity to transport more than 1.3 billion passengers yearly over the next 20 years, the Indian

aviation sector is sizable in scale. There are currently 148 airports in India, which has the third-largest domestic market in terms of seat capacity in the world.

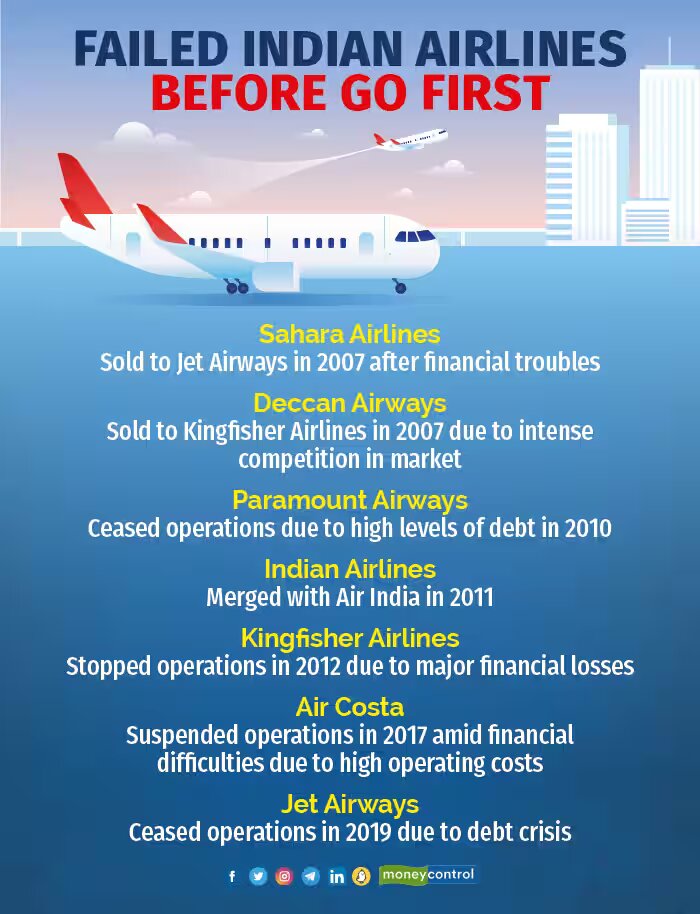

aviation sector is sizable in scale. There are currently 148 airports in India, which has the third-largest domestic market in terms of seat capacity in the world. - Airlines in India have had difficulty surviving in the fiercely competitive and harsh aviation industry, despite being hailed as having the “fastest-growing aviation sector” globally. In the last few decades, major airlines have folded due to financial difficulties, with seventeen domestic and regional airlines leaving the market.

- All carriers had severe financial losses following the COVID-19 pandemic, but this was not a post-COVID occurrence. IndiGo was the only airline to turn a profit in 2019–20, while every other competitor experienced a loss. The epidemic caused India’s airlines to lose a total of $15,000 crore in the fiscal year 2020–2021.

- Smaller airlines may find it much harder to enter the market as a result of the Tatas’ consolidation of four carriers, including Air India and Vistara, under one roof, noted CAPA in a recent research. With this consolidation, Indigo and Air India will control between 75 and 80 per cent of the market, leaving just 20 per cent for competitors like SpiceJet, GoFirst (if it recovers), and the most recent newcomer Akasa.

- The Ministry of Civil Aviation in India is responsible for broad-based aviation policy, which is governed by the Aircraft Act of 1934 and the Aircraft Rules of 1937. The DGCA is the statutory regulatory agency that responds to inquiries on safety, licencing, airworthiness, and other related topics.

- Although the original Act and Rules have undergone numerous revisions, aviation experts contend that India needs to keep up with advancements in aircraft technology, which has led to higher industry costs and, eventually, a decline in passenger growth.

- Aviation turbine fuel (ATF) is heavily taxed, with ATF taxes accounting for anywhere between 40 and 50 per cent of carriers’ operational costs. Some Indian States charge up to 30% in provincial taxes on jet fuel. Additionally, this renders shorter travel distances unprofitable for smaller airlines. At the same time, big carriers like IndiGo offer incredibly low tickets on routes flown by competitors, using their reach to recover expenses on less lucrative legs and utilising economies of scale to reduce overheads.

- The Indian aviation policy has created obstacles to growth and entry while also having an uneven impact on different businesses. To fly internationally, new airlines in the nation had to have been in business for at least five years and have a fleet of at least 20 aircraft from 2004 to 2016, which stabilises the operations and viability of carriers. The National Civil Aviation Policy (NCAP) of 2016 brought about a change in this by eliminating the five-year domestic experience requirement while maintaining the requirement for domestic airlines to operate at least 20 aircraft (or 20% of their total fleet size, whichever is higher) for domestic operations.

Similar Topics

Indian Aviation: Industry Drowning

aviation sector is sizable in scale. There are currently 148 airports in India, which has the third-largest domestic market in terms of seat capacity in the world.

aviation sector is sizable in scale. There are currently 148 airports in India, which has the third-largest domestic market in terms of seat capacity in the world.