Pakistan passes Bill to meet FATF demands

Context :

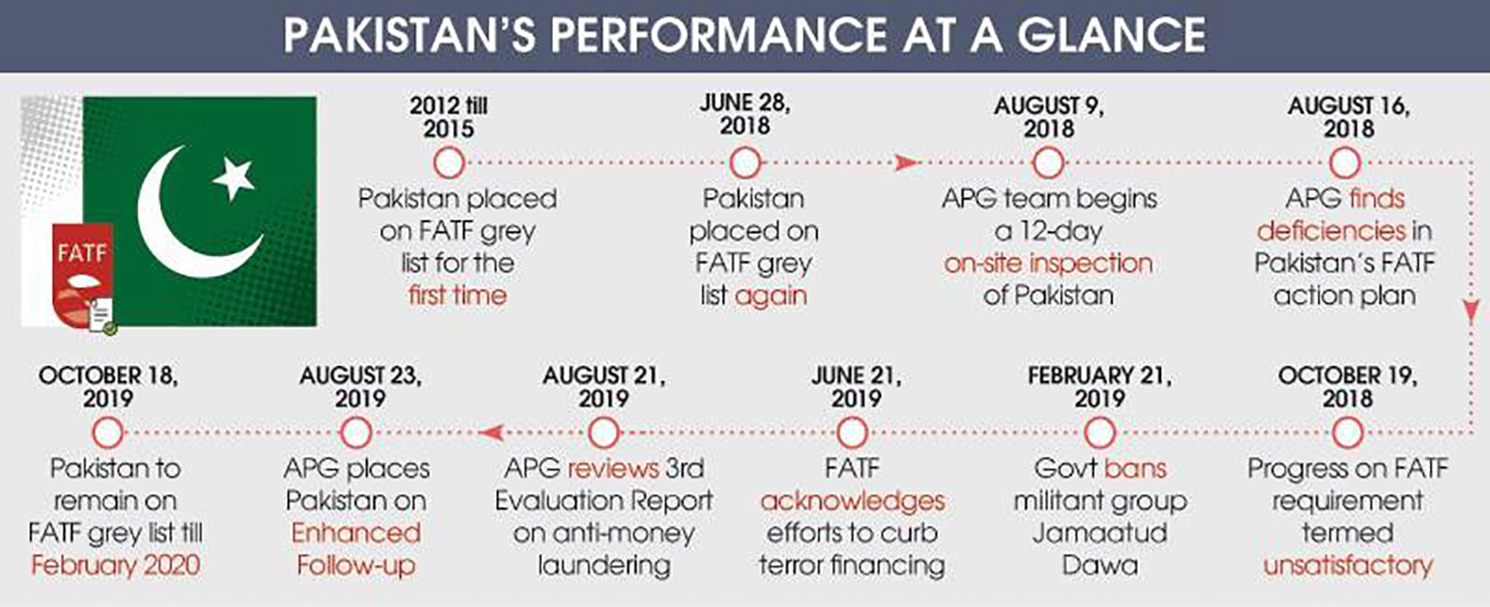

The Financial Action Task Force (FATF)’s “grey list” is a list of nations that have been identified as having a high risk of money laundering and terrorism funding. On Friday, the Pakistani Senate approved a bill to create a new authority to combat these activities.

What is FATF?

- The Financial Action Task Force (FATF) is a global watchdog for financial crimes like money laundering and terror financing.

- After member countries raised worries about growing money laundering operations, it was founded at the G7 Summit in Paris in 1989 to fix gaps in the global financial system.

- FATF included terror funding as a key emphasis area in the aftermath of the 9/11 terrorist attacks in the United States. Later, this was expanded to include a ban on the funding of weapons of mass devastation.

- There are presently 39 members of the FATF. The FATF’s plenary, or decision-making body, meets three times a year. 206 countries from the global network, including members and observer organisations like the World Bank, attend its meetings.

- The FATF establishes standards or suggestions for countries to follow to close loopholes in their financial systems and reduce their vulnerability to unlawful financial activity.

- It performs frequent peer-reviewed evaluations of countries called Mutual Evaluations (ME) to assess their performance against the standards it sets.

- FATF and FATF-Style Regional Bodies (FSRBs) conduct the reviews, which are then published as Mutual Evaluation Reports (MERs).

- Time-bound action plans are developed for countries that do not meet specific benchmarks. The recommendations for governments vary from analysing criminal threats to establishing legislative, investigative, and judicial tools to prosecute money laundering and terror financing cases.

What are the various types of lists?

- While the terms ‘grey’ and ‘black’ lists do not appear in the official FATF lexicon, they denote countries that need to improve their compliance with FATF regulations and those that are not.

- FATF publishes two lists of countries after each plenary meeting. The grey countries have been identified as “jurisdictions under heightened supervision,” and they are collaborating with the FATF to combat unlawful financial activity.

- The watchdog does not advise other members to take due diligence measures concerning the listed country, but it does advise them to examine the risks that such countries pose. There are now 23 countries on the grey list, including Pakistan.

- The term “black list” refers to countries that have been identified as “high-risk jurisdictions subject to a demand for action.”

- In this situation, the countries’ AML/CFT (anti-money laundering and counter-terrorist financing) regimes are very deficient, and the body urges members and non-members to exercise increased due diligence.

- In the most extreme incidents, members are instructed to take countermeasures, such as imposing penalties on the countries on the list. North Korea and Iran are currently on the blacklist.

What is Pakistan doing to stay out of the grey list?

- Purpose: The Bill’s purpose is to create a new authority in Pakistan to effectively tackle money laundering and terrorism financing. Pakistan wants to do this to increase cooperation among relevant agencies, strengthen its financial regulatory system, and show its support for global efforts to combat financial crime.

- Legislative process: The Bill underwent the legislative procedure in the Pakistani parliament, where it was first enacted by the National Assembly and then endorsed by the Senate. This two-step approval procedure makes sure that both houses of parliament will support the proposed law.

- Central Authority: The National Anti-Money Laundering and Counter Funding of Terrorism Authority, which will be in charge of coordinating and supervising efforts to stop money laundering and funding of terrorism across various institutions, is to be created as a result of the proposed legislation.

- Under One Command: All Financial Action Task Force (FATF)-affiliated institutions will be under a single command thanks to the new authority. In dealing with financial crimes, this unified strategy is anticipated to increase collaboration, information sharing, and effectiveness.