Analyzing India’s Economic Landscape

Context:

In the first quarter of the year, the GDP and GVA showed 7.8% growth, signifying a positive turn for the Indian economy. However, this growth fell slightly short of the 8% target set by the Reserve Bank of India (RBI).

Relevance:

GS-03 (Indian Economy)

Prelims:

- GDP

- Inflation

- Monetary policy

Mains Question:

- Discuss the trends in India’s economic growth and the potential challenges it may face in trying to become the 5 trillion economy. (150 words).

Dimensions of the Article:

- Growth Trends and Projections

- Agricultural Sector and Monsoon Uncertainty

- Services Sector

- Investment Cycle and Manufacturing

- Inflation and Fiscal Risks

Growth Trends and Projections:

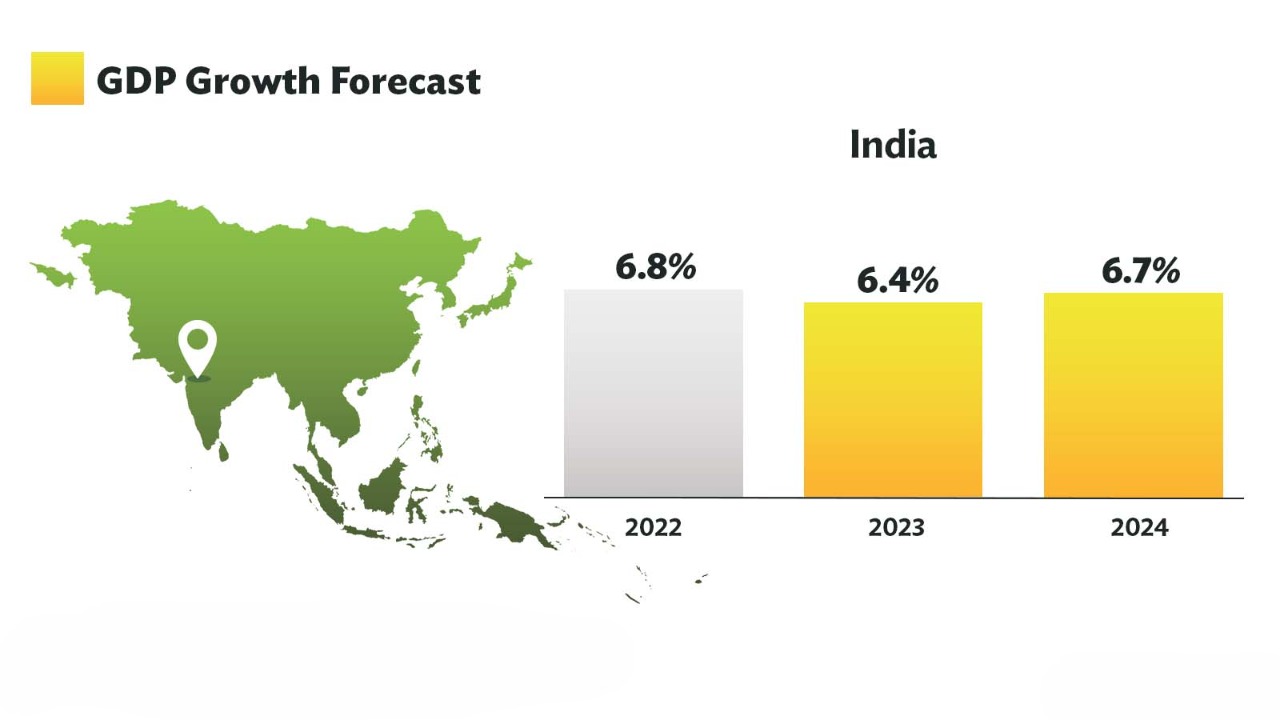

- The 7.8% growth is promising, but it is just below the Reserve Bank of India’s initial estimate of 8%.

- Chief Economic Adviser V. Anantha Nageswaran remains optimistic, asserting that these figures do not undermine the possibility of achieving a 6.5% growth rate for the entire year.

- This places India in a favorable position as the fastest growing major economy, surpassing China’s 6.3% growth rate in the same quarter.

Agricultural Sector and Monsoon Uncertainty:

- While the farm sector’s GVA showed steady growth at 3.5% in Q1, concerns arise due to the slow progress of the monsoon and the looming threat of low reservoir levels impacting the rabi crop.

- This adds an element of unpredictability to the agricultural sector, which plays a pivotal role in India’s economy.

Services Sector:

- The services sector demonstrated robust growth, with trade, hotels, and transport expanding by 9.2%.

- The fact that employment-intensive segments still remain 1.9% below pre-COVID-19 levels suggests that the recovery is far from complete.

- It raises questions about the depth of the revival in this crucial sector.

Investment Cycle and Manufacturing:

- Government claims of a revived private investment cycle are countered by data on gross fixed capital formation, which reveals that government capital spending is the primary driver.

- Although manufacturing GVA has seen a slight uptick, going from 4.5% to 4.7%, a comprehensive resurgence in consumption demand is still awaited.

- Private consumption spending grew by 6%, but experts believe this growth primarily stems from high-income earners.

- The durability of this growth hinges on the persistence of elevated inflation, especially in essential food items.

Inflation and Fiscal Risks:

- Inflationary pressures pose a significant challenge, potentially impacting demand from lower-income segments and rural areas. Interventions to counter inflation, such as export restrictions on rice and onions, may impede overall economic growth and disrupt the external trade balance.

- Relief measures like the recent ₹200 reduction in LPG cylinder prices, which could become more common ahead of the general election, present fiscal risks that need to be carefully managed.

Way Forward:

- India must navigate these challenges while capitalizing on its growth potential. Balancing fiscal measures to control inflation with the need for sustained economic growth remains a priority. Additionally, focusing on job-intensive sectors and encouraging private investment will be crucial for a more inclusive recovery.

Conclusion:

- While the recent GDP and GVA growth numbers are promising, various challenges loom on the horizon, including agricultural uncertainties, incomplete recovery in employment-intensive sectors, and persistent inflation. The government must adopt prudent fiscal and economic policies to ensure a more balanced and resilient growth trajectory, ultimately benefiting all segments of the population. The road ahead may be uneven, but with careful planning and strategic actions, India can continue to chart its course toward economic prosperity.