Sovereign Gold Bond

Context:

- The Government of India has notified that the Sovereign Gold bonds are open for subscription.

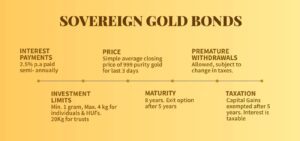

- The issue price of the Sovereign Gold Bond during the subscription period will be Rs.5091.

About Sovereign Gold Bond

- The Sovereign Gold Bond is issued by Reserve Bank of India on behalf of the Government of India

- The minimum investment to be made is the value of one gram of gold, the bond can be purchased in terms of quantity of gold.

- The bondholders will be paid an interest of 2.5% annually on the total value, the interest will be paid to the bondholder semi-annually.

- The maturity period for Sovereign Gold Bond is eight years, with an option of premature exit after five years.

What is the purpose of its introduction?

- The Sovereign Gold Bond scheme which was initiated in the year 2015 was introduced with a purpose of reducing the demand of physical gold.

- By reducing the usage of physical gold, the domestic savings instead of being lying as physical gold can be transferred into financial savings.

- This also helps the buyer in terms of storage cost, problem of theft and damage.

- Apart from this this bond also bears with it an interest which is paid semi-annually.

- And also, physical gold depreciates with time, it will not hold the same value as at the time it was purchased.

Source The Hindu

For more updates, Click Here